The Cliff Ahead: Why the AI “Bubble” Still Has Room to Run

October 24, 2025

“Markets are wrapping up the week on a strong note. Inflation-sensitive stocks rallied after U.S. inflation data came in cooler than expected, reinforcing expectations that rate cuts remain on track. As of Friday morning (8am PST), the Nasdaq is up over 1%, the Dow is higher by nearly 1%, and the TSX has gained about 0.6%. Despite some midweek volatility, it’s shaping up to be a solid, if choppy, finish to the week.

Are We in an AI Bubble?

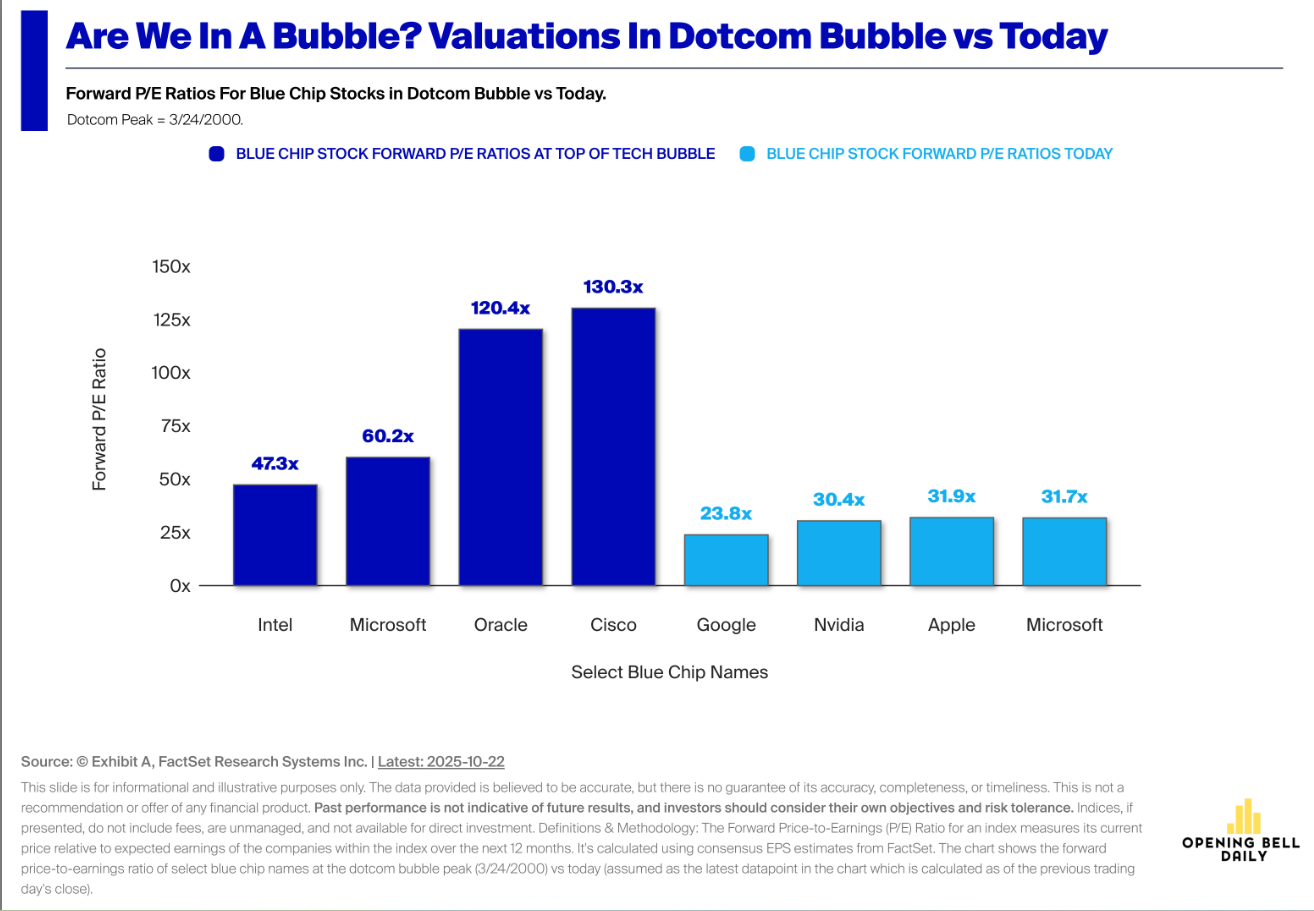

As fashionable as it has become to talk about an “AI bubble,” the data suggest markets are nowhere near the extremes of the dot-com era. Valuations for today’s leading technology companies remain elevated but justifiable. Nvidia, Apple, and Microsoft each trade around 30× forward earnings while generating record profits and free cash flow. Google looks even cheaper.

Compare that with the late 1990s, when Cisco and Oracle traded at more than 120× earnings, and Microsoft’s multiple was roughly double its current level—despite being a much smaller, less profitable business at the time. That gap matters. The companies leading this cycle are producing hundreds of billions in annual free cash flow and have fortress-like balance sheets. They’re not running on borrowed money or speculative promises, they’re driving real economic growth.

When Everyone Sees the Cliff

If anything, the fact that everyone’s talking about a bubble may be the best evidence that we’re not actually in one. Market sentiment has a long history of overshooting in both directions. When investors become convinced that a certain outcome is inevitable — whether it’s a recession, runaway inflation, or now an AI bubble — the crowd tends to adjust in advance, often preventing the very thing they fear.

It’s a bit like driving and spotting a cliff ahead. Once you see it, you don’t keep going — you turn the wheel. Investors do the same. They trim risk, reallocate portfolios, or move into safer assets. Those defensive moves collectively reduce the odds of disaster. When everyone’s preparing for a crash, they’re less likely to cause one.

As these defensive moves take place, what they really do is release pressure. By adjusting portfolios, trimming risk, and building in safeguards, investors allow the so-called “bubble” to keep expanding in a controlled way rather than bursting. That’s where we are now, still moving forward but with far less recklessness than in past cycles.

In my view, the cliff everyone’s worried about is still a long way off. We haven’t hit the stage of excessive leverage or dangerous speculation that typically signals the end of a cycle. The benefits of AI, meanwhile, are still rippling through the broader economy, in productivity, infrastructure, and corporate profits, and that’s a train worth riding for the time being.

Another thing I’m watching closely is the U.S. government shutdown. It hasn’t received as much attention as the tariff debates, inflation, geopolitical uncertainty, or the ongoing discussion around AI spending and regional banks, but it matters. When the government shuts down, a large pool of liquidity effectively gets trapped, which temporarily tightens financial conditions. I believe that tightening is one reason we’ve seen some pullback in riskier assets over the past week.

Still, I expect that to be short-lived. Just as trade negotiations between Canada, China, and the U.S. will eventually find resolution, the government isn’t going to remain closed indefinitely. Talks are already underway, and even if they end up kicking the can into the new year, a deal will come. When it does, the release of that withheld liquidity should give markets another boost. That’s one more reason I expect the final quarter of the year to remain supportive for equities and other risk assets.

Bottom Line:

Historically, the fourth quarter has been one of the strongest for equity markets. Since 1950, the S&P 500 has averaged a 4.2% return in Q4, nearly double any other quarter, and finished positive about 80% of the time. That seasonal tailwind, combined with continued economic resilience, supports the view that markets could stay firm through year-end.

The real risk isn’t optimism—it’s leverage. Bubbles burst when companies or investors borrow excessively. We saw that in 2008, in crypto, and during the dot-com crash. Today’s AI leaders are spending cash they already have, not debt. As long as those balance sheets stay strong, the risk of a sudden collapse is limited.

Are we in a bubble? Maybe a small one forming (and that’s not a bad thing)—but not close to popping. With solid earnings, limited leverage, and a historically strong fourth quarter ahead, we remain invested and optimistic about what’s next.”

Best regards,

Mark, Leanne, and James

Book an appointment with Mark: https://calendly.com/mark-ting

Book an appointment with Leanne: https://calendly.com/leanne-brothers

Book an appointment with James: https://calendly.com/james-pelmore

Foundation Wealth Partners LP is registered as a Portfolio Manager and Exempt Market Dealer in all Canadian provinces and the Yukon Territory. Certain statements in this email are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” intend,” “plan,” “believe,” “estimate” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained in this document are based upon what Foundation Wealth Partners believe to be reasonable assumptions, Foundation Wealth Partners cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on the FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.